Truist Bank Rewards Website

About This Project

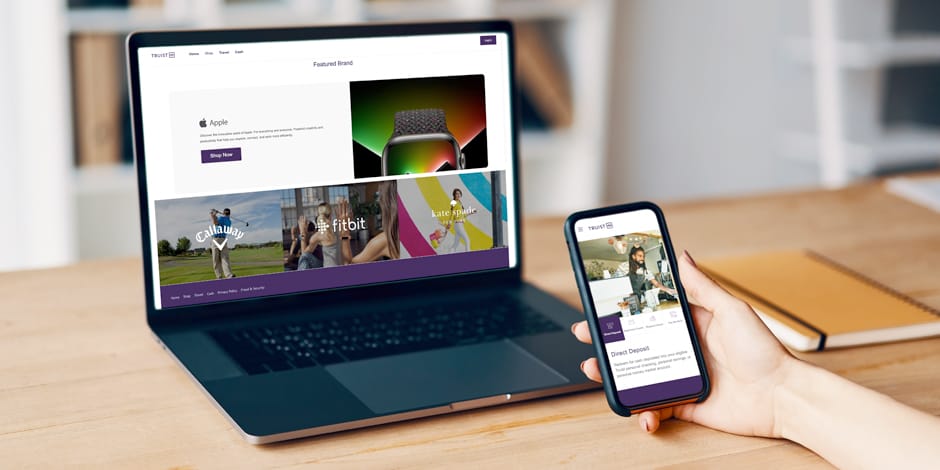

Bridging Two Giants: Crafting the Truist Unified Rewards Experience

When SunTrust and BB&T merged to form Truist, the challenge wasn’t just combining two banks—it was merging two distinct user legacies into one seamless, high-performance ecosystem. As the Senior Front-End UX/UI Implementation Designer, my mission was to translate complex business logic into a frictionless rewards platform that felt personal to millions of users.

The Purpose: Empowerment Through Choice

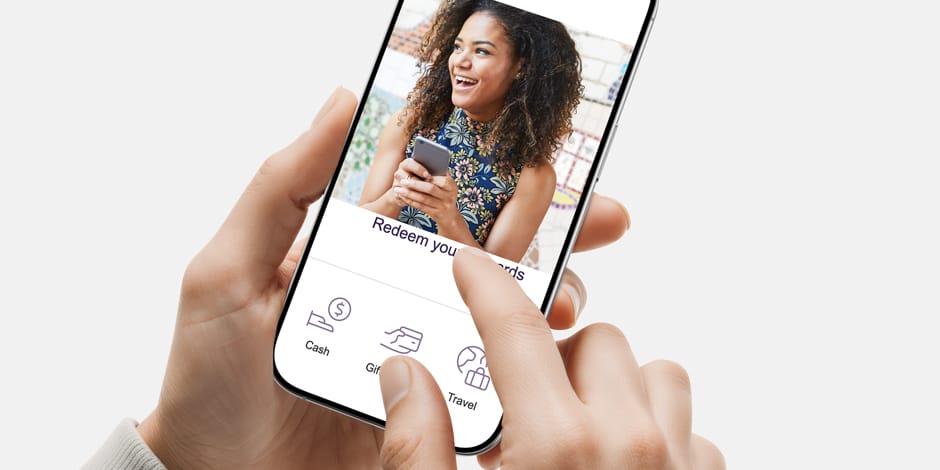

The Truist Rewards platform is designed to be more than a catalog; it is a personalized financial tool. Its purpose is to give members total agency over their earned value, whether they are looking for long-term travel memories or immediate financial flexibility.

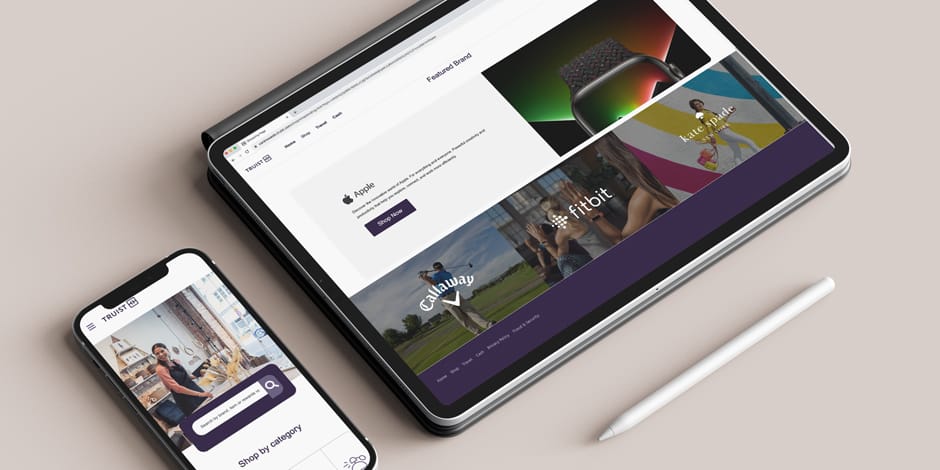

My role focused on ensuring that this “freedom of choice” was reflected in the interface. Because the platform serves a massive variety of credit card portfolios, the UI had to be intelligently dynamic.

Strategic Implementation & Logic-Driven Design

The transition required a massive migration and a complete overhaul of the legacy catalog. I spearheaded the implementation of the UI with a heavy focus on:

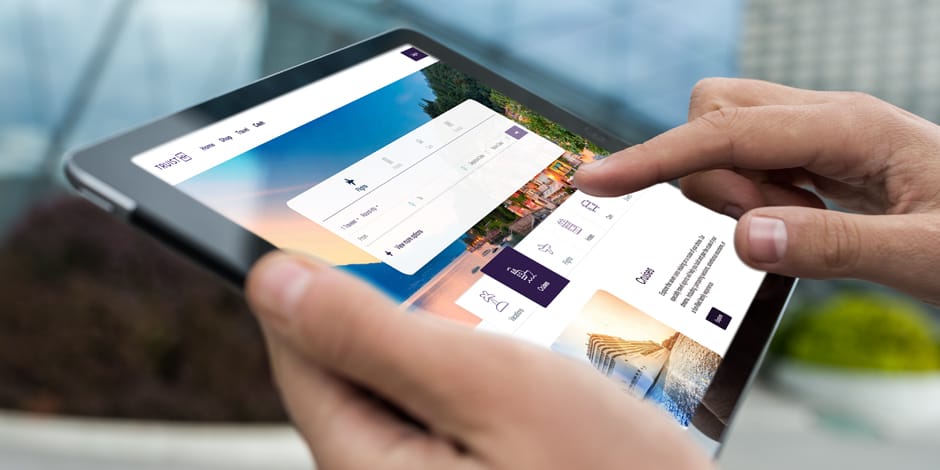

- Conditional User Journeys: Not all rewards are created equal. I implemented complex logic that tailored the interface based on the user’s specific card—ensuring a “Miles” cardholder saw a travel-first experience, while “Cash Back” members saw immediate liquidity options.

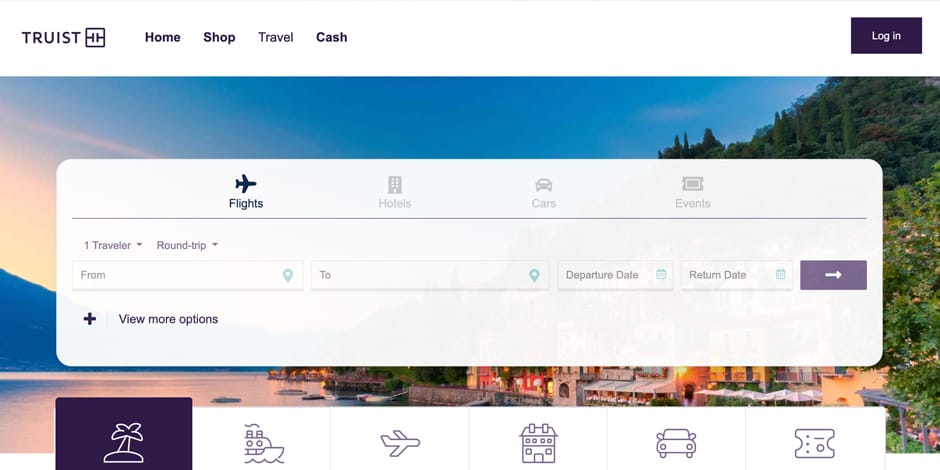

- A Unified Commerce Ecosystem: I helped implement an existing comprehensive shopping catalog and a full-scale Travel Concierge. This allows users to book flights, hotels, car rentals, and events in one unified space without “portal fatigue.”

- Flexible Redemption Architecture: Understanding that users value cash differently, we implemented four distinct cash-back paths:

- Direct Deposit: Seamless integration with Truist accounts.

- Statement Credit: Instant debt reduction.

- Paper Check: For those who prefer traditional tangibility.

- “Pay Me Back”: A modern UX feature allowing users to apply rewards directly to specific past purchases.

The Impact

By bridging the gap between high-level design and technical front-end implementation, we successfully migrated two distinct bank populations into a single, cohesive rewards brand. The result is a platform that scales with the bank’s growth while making every individual user feel like the catalog was built specifically for their wallet.